Updated: 10/18/18

Here's the brutal truth about startup engagement:

There are way too many people in corporate innovation today that think "engaging with the ecosystem" is enough.

They say "If I go outside my office, venture down to the place where entrepreneurs hang out, and build a presence there, innovation and collaborations will fall into my lap".

If only it were that easy.

If you're serious about empowering innovation in your corporation by engaging with startups, you need to be very systematic in your strategy.

Well today I'm going to show you an entire overview of the corporate startup engagement landscape and the foolproof strategy that almost guarantees that you will get high quality, purposeful engagements from every startup you work with.

Keep reading to learn how...

Say Hello The Stoplight Innovation Technique (Corporate Startup Engagement for Innovators)

We started calling this the Stoplight Innovation Technique.

Don't worry. I know it looks complicated -- it's not. We'll cover the nuts and bolts of this entire outline later on in this document.

What's important to know for now is: after deploying the stoplight technique with innovation leaders at Fortune 100s who were engaging with startups, the results were outstanding.

Initially, we considered keeping this to ourselves, only making it available to people who were paying us, and making it a part of our private arsenal.

But, as the months went on, and we began having more and more conversations with people in the space -- we learned that someone got to them before us.

The worst part?

This "someone" poisoned the well.

These are real quotes of things we were hearing at our first meetings:

- "We ran a Hackathon and it got us nowhere."

- "We've been sponsoring an accelerator for the past 3 years and I have no idea if there is been any return."

- "A local venture capitalist sold us on a startup to work with and after we signed a contract, they pretty much disappeared."

- "We stood up an entire department for engaging with startups and had limited results."

- "I see the value, but I can't get other department heads to buy-in."

- "I have no idea where to start."

So how did this happen?

Persuasion, mostly -- someone thinking they had the next sliced bread or perhaps even knowing they didn't, but having the authority to sell it anyway.

Or maybe a bit of the current environment working against us.

Or maybe we were paying for the mistakes of the people that threaded the needle before us. Either way, it doesn't matter.

Because of that, we're making the Stoplight Innovation Technique available to whomever chooses to read it, in hope that we don't have more quotes to add to the scoreboard above.

You could jump to the bottom of this document and learn the Stoplight Technique, but for the nuts and bolts on the why, read on.

Let's jump in...

Introduction

Corporations innovating with startups, in one form or another, is a hot topic, and it can be confusing for individuals who are assigned to this key role.

With terms like incubator, accelerator, hackathons, intrapreneurship and corporate venturing frequently mentioned, but rarely defined, the menu of corporate startup innovation options can be overwhelming.

So far, while individuals in this budding space are establishing a common vocabulary, we at Gearbox have been looking at the defined landscape such as this: Corporate Startup Engagement, Corporate Startup Innovation, Startup Collaboration, and Corporate Venturing (as is more the popular term in Europe).

- Corporate startup innovation = broad. This is generally used when referring to any type of innovation that involves a startup.

- Corporate startup engagement = specific. This refers to seeking interactions with a distinct purpose between both parties.

- Corporate venturing = building. Again, an overview topic, but mostly for the purpose of creating something alongside a startup.

- Pilot = Testing. An engagement for the purpose of a small experiment with a startup. This is the midway point of the Stoplight Innovation Technique.

A useful framework for understanding corporations innovating with startups first distinguishes what innovation assets are owned and controlled by the corporation -- and which assets are not.

These innovation assets include everything from patents, technology, inventions, business models, customer contracts, data, outcomes and even legal entities.

Innovation Horizons

Using McKinsey’s Three Horizons of Growth framework as a compass for such assets, corporate startup innovation must then operate across three horizons.

H1

Horizon 1 (H1) includes the corporation’s core businesses, the ones whose business models provide the greatest profits and define the corporation’s brand.

Example: P&G’s Tide detergent business, or BMW’s Series 3 compact car business (below)

H2

Horizon 2 (H2) includes emerging opportunities that have already gained significant traction.

Example: Amazon’s Echo business. Google Cloud.

H3

Horizon 3 (H3) includes the corporation’s efforts, essentially experiments, to harness disruptive ideas that could provide profitable growth in the future, once the appropriate business model is identified.

Example: the experiments conducted by various financial services institutions, such as Barclays, around blockchain technology.

Most corporations focus the bulk of their startup engagement efforts on extending the life of their H1 businesses.

In fact, corporations such as Unilever, MasterCard, and American Express routinely partner with or acquire startups to gain access to specific technologies that could help them address their H1 innovation needs.

Some corporations are also successful in identifying and investing in H2 initiatives that are based on adjacencies of H1 businesses and using them to eventually create new H1 businesses.

For example, Boeing created the Boeing Business Jet as an adjacency to its venerable 737 passenger jet by investing in new technologies and targeting a new market. It succeeded in creating a new, strong business unit.

Corporations have only just recently become more comfortable at launching H3 experiments.

In fact, corporations from many industries are establishing Innovation Outposts in clusters such as Silicon Valley and Israel. Boeing, again, is one such example in the former.

Through these Outposts, corporations incubate, invest in, partner with, and acquire startups. To these startup-centric H3 experiments, one has to add certain relevant corporate R&D efforts.

However, even as they are improving in their ability to launch H3 experiments, corporations fail in consistently growing these efforts to the point where they become their next-generation H1 core businesses. (Think Samsung before phones).

The #1 Goal of Engaging With Startups is Access

If we were to agree on a singular core thesis for this document, it would be:

innovation is proximity.

The conversations around the water cooler. The elevator rides.

The chance bump-ins that co-workers have from time to time.

Internal innovation's catalyze on the outskirts of the daily work life.

Pro tip: More often, this is also where two employees discover that they could be doing a similar business better, faster or cheaper and go off to become a competitor when the company doesn’t have a way to harness such endeavors, such as an intrapreneurship program.

In order to improve in this area, corporations must:

1) Become ambidextrous organizations continuously executing well on their H1 business models and continuously innovating across all three horizons.

2) Recognize that H2 is the most critical horizon to the scaling and ultimate success of their corporate innovation initiatives, necessitating that they focus appropriately on their H2 efforts.

McKinsey labels the corporations that possess these characteristics as 3-Horizon Corporations.

The management of H2 projects is further complicated by the fact that there exist two distinct types of such projects:

Type 1: The purpose of these projects is to use as a basis an existing business to extend to an adjacent market with the goal to create a new core business for the corporation.

In addition to Boeing’s Business Jet business, NVIDIA’s growing automotive business that is based on the company’s GPU chips is a Type 1 example.

The Type 1 projects:

- Create products that adapt existing technology or create new technology that is deployed on an existing platform.

- Enter a new market, one that may already exist but the corporation has not previously penetrated, or a nascent market;

- May not necessarily employ a new business model.

Type 2: The purpose of these projects is to start scaling validated H3 experiments to create new H1 core businesses that may have little, if anything, to do with the corporation’s existing core business units.

These experiments may have been results of the corporation’s Innovation Outpost’s efforts or may have started internally as R&D projects.

But consider this...

Research and Development = Inside-Inside

Research and development has been an innovation lifeblood of our economy for nearly 50 years, and continues to be important for corporations.

According to the National Science Foundation, in 2015, corporate R&D accounted for $355 billion out of a total U.S. investment of $499 billion in research and development.

That’s a lot of money.

But is it worth it?

These corporate innovation efforts start inside (as research) and stay inside (as development).

Here the innovation assets begin as fundamental science and engineering, patents and business plans, potentially turning into new products or even entire lines of business for “intrapreneurs” attempting to complement or extend the company’s core business.

These internal innovation efforts represent an opportunity for corporations to disrupt themselves, as they chart the path of their evolving businesses.

Understandably, the corporation maintains full control of its R&D innovation assets at all times.

Through this model, innovations become intellectual property assets and possibly competitive advantages.

However, the majority of these ideas exist in a silo and personnel at corporations are known to be risk-averse.

On a fundamental level, an Inside-Inside innovator’s role should be to force the enterprise to consider opportunities out of the normal risk profile of the company or to establish processes to help the company routinely explore new growth tangents.

This requires expansive thinking to push the boundaries of the organization.

Corporate Accelerators/Incubators = Inside-Outside

Like R&D, incubation is, again, a form of internal innovation.

In the most common incubator model, ideas are generated inside the corporation, developed and then spun out.

Because the entity that owns the incubator plays such a prominent role in creating the new business, incubators often receive equity ownership stakes similar to those of startup founders.

Incubators typically recruit entrepreneurs to take ownership of the startup, although sometimes internal employees spin out along with the new company.

Not all internally incubated business concepts are spun out, in which case they are functionally similar to R&D.

Corporate incubators nearly always focus on sectors relevant to the parent company, and there are many examples of successful corporate incubation programs and startup spin-outs, including:

- McDonalds’s spin out of Red Box (acquired by Coinstar for $150-plus million)

- Google’s spin out of Niantic Labs & Pokémon GO (reportedly worth $3.5 billion)

- Oracle Labs’s development of the Java programming language

- Amazon’s Lab 126 creation of the Kindle, Echo and Fire products

According to New Markets Advisors, a significant portion of Fortune 500 companies — including Procter & Gamble, IBM, Walgreens and The Hershey Company — have some sort of incubator efforts in at least one business unit.

On the other hand, incubation can be routinely fruitless.

A 2012 study of 300 corporate incubators stated that only half deliver on their strategic goals, and only a quarter deliver on their financial goals.

It’s also important to note that not all incubators are housed inside corporations.

Idealab is a successful 20-year-old startup studio in Pasadena, California that has launched more than 150 startups, but is independent of any specific corporate parent.

In addition to its accelerator and venture fund, Betaworks also operates a “startup studio” that founds new companies, develops the concepts into fundable businesses and spins them out.

In the corporate incubator model, the corporation maintains full control of its innovation assets until such time as the new company is spun out. The corporation may maintain minor or partial control after the spin out.

Our research suggests a range of questions leaders of corporate accelerators need to answer.

These considerations fall into four key design dimensions.

- (What) Proposition -- what the program offers;

- (How) Process -- how to program is run;

- (Who) People -- who is involved; and

- (Where) Place -- where the accelerator is hosted.

For each dimension, managers receive decision support on how to set up or enhance corporate accelerators.

- Definition the Proposition: The first design dimension related to the proposition, which defines the relationship between the corporation and the startup. The proposition frames the interplay between process, people, and place. The collaboration needs to fuse corporate and startup interests to create mutual value.

- Clarification of innovation goals: Before working with startups, corporations need to clarify their strategic intent.

- Closing the innovation gap: In general, existing business units are not likely to pursue disruptive concepts and often face strong near-term pressures that discourage investments in new growth initiatives.

Accelerators: Outside-Inside-Outside

Accelerators are examples of external innovation, in which startups are born “in the wild” and apply to participate “in the wild” in a limited-time program with a mix of academic curriculum and unstructured elements.

The programs deliver benefits that leave the startups in an advanced condition compared to when they started.

These benefits can include things like...

- mentorship,

- technical product assistance,

- business development introductions,

- recruiting support,

- legal services,

- fundraising advice

- and sometimes capital investment, as well.

As a result, innovation assets start outside the corporation, go inside the accelerator and then return to the outside economy, after completing the program.

If you are trying to distinguish between incubators and accelerators, remember this rule of thumb:

If a startup can apply to participate in the program, it’s generally an accelerator, not an incubator.

Accelerator programs are often loosely affiliated with corporations but managed by third parties.

TechStars is the most visible example of this approach, operating specific programs for Amazon Alexa, Barclays and Cedars-Sinai.

These programs typically offer investment in exchange for ownership, usually between 5-10 percent of the startup’s equity, and not approaching the “co-founder” stakes in the incubator model. These programs provide corporations with the opportunity to explore commercial deals with startup participants.

As with incubators, there are many accelerators that are not affiliated with corporations. However, their sub-2% success rate has recently come under scrutiny.

In the corporate accelerator model, the corporation maintains limited control of a startup’s innovation assets during the time the startup is participating in the accelerator program.

If the terms of the accelerator program also include an investment or board representation, the corporation may also maintain limited ongoing control.

M&A: Outside-Inside

Mergers & acquisitions is a well-understood technique for bringing external innovation in-house, with $1.7 trillion spent by U.S. and European corporate buyers, according to PitchBook.

In this model, innovation assets (i.e. startups and established companies) begin outside the corporation and are brought inside the corporation via acquisition.

In the M&A model, the corporation maintains full control of a startup’s innovation assets beginning at the time of acquisition.

R&D has long been a trusted methodology for internal corporate innovation, while M&A is an established way to bring external innovation (outside) under corporate control (inside).

Over the coming decade, ongoing corporate exploration of the incubator, accelerator and venture capital models will expand the use of these additional forms of external innovation, too.

Key takeaway: Early stage access to startups and their founders will become mission critical in order possibly acquire or partner with a startup before they are too large and unwilling to consider buyout options.

INNOVATION DIMENSIONS

Bridging into our original outline: the two types of H2 business are different along five dimensions:

- Risk,

- timelines to success,

- employee culture,

- leadership characteristics, and

- required investment.

Risk

Type 2 projects are generally riskier than Type 1.

With Type 1 projects the corporation assumes some market risk (since the market exists even though the corporation has not previously operated in it), some technology risk (since the corporation has to adapt its technology to the market and even create new technology in order to best serve the selected adjacent market), and some team risk (the characteristics of the team are closer to those of the H1 businesses that was used as the basis for the H2 project but they still need to have entrepreneurial characteristics).

With Type 2 projects the corporation assumes market risk (since the selected market is nascent, or not established), business model risk (since the model is new and only in the process of starting to scale), team risk (since the team must consist of entrepreneurs that understand the new technology and market rather than the type of executives that staff the corporation’s core business units), and technology risk (since through the H2 project the corporation will be testing the broad scalability of the technology developed by the H3 experiment).

Staying with me? Good.

3-Horizon Corporations are able to simultaneously pursue several Type 2 projects but, like in the case of H3 initiatives, they are prepared to stop the ones that do not show the potential to scale to next-generation H1 core businesses.

Type 2 projects must continue to work closely with the corporation’s Innovation Outpost.

The Innovation Outpost may even play an active role in setting up the organization of each H2 project.

Timelines

Type 2 projects require longer timelines to becoming candidates for Horizon 1 businesses than Type 1 projects. This is because Type 1 projects typically employ an existing business model, one which the corporation and the H2 business’ management team are familiar with, to enter an existing though adjacent market.

On the contrary, in Type 2 projects the business model is still not solidly established (especially right after the transition from H3 to H2), and the market being addressed is nascent; both factors that lead to the longer timelines.

Culture

The culture created in Type 2 organizations must always be a departure from the parent corporation’s culture. While both types of projects require teams with entrepreneurial drive, Type 2 projects require teams that are prepared to deal with significant uncertainty and probability of failure.

They must also be able to establish a new organizational culture that will eventually become the culture of the new H1 core business unit.

While doing so, the members that are initially part of the Type 2 organization will need to ensure that the culture they establish is adopted by all new employees, even those that transfer from H1 core business units, and is strong enough to withstand the tendency by the rest of the corporation to reject it and revert to the established culture.

Because Type 1 projects are adjacencies of existing H1 businesses, the employees of these organizations, though entrepreneurial, typically inherit the culture of the core business unit they came from.

Leadership

While both project types require entrepreneurial leaders, the leaders of Type 2 projects must not only be entrepreneurial but also be able to operate under uncertainty and be flexible to change.

Various team members of these projects may need to be replaced and/or augmented during the journey from H3 through H2 to H1.

Venture investors frequently make changes to their startups’ leadership teams.

This is because a team that, for example, can lead the startup from $10M to $30M in annual revenue may not be able to take it to $70M or $100M in annual revenue.

Oftentimes the first member to be replaced is the CEO of Type 2 projects.

Other times executives reporting to the CEO may need to be upgraded, and new executives may need to be hired by the organization to fill positions that were not necessary for a $20M business but are important to a $70M business, e.g., chief legal counsel.

A good example of such transitions is the hiring of John Krafcik to lead Google’s Waymo autonomous car business unit (below).

The leaders of Type 1 projects typically come from the H1 core business unit and eventually become the leaders of the new H1 core business unit.

Investment: Because of their characteristics and until they become large and stable enough businesses to transition to new H1 core business units, Type 2 projects require a higher investment than their Type 1 counterparts.

Moreover, because Type 2 projects take longer before they become new H1 core businesses than Type 1 projects, the corporation must be prepared to fund such efforts over longer periods of time and continue to support them even when they hit performance troughs, which, like every startup, they will undoubtedly do.

The necessary investment may come in tranches based on the achievement of previously established milestones. In other words, the tranche should not be released automatically but be based on the critical evaluation of the project’s performance.

The evaluation of the H2 project before each new tranche of funding is released is also an opportunity to determine whether the project should continue or be eliminated.

Of course, the milestones that must be achieved before obtaining the next tranche of this investment must also be more flexible for Type 2 projects than for Type 1, because of the issues associated with introducing a new product, to a new market, using a new business model.

3-Horizon Corporations simultaneously launch multiple H3, startup engaging experiments.

WHY?

Because these lead to several Type 2 projects.

At the same time, these corporations typically pursue at least 1-2 Type 1 projects and maybe even a moonshot.

This means that at any one time 3-Horizon Corporations must manage multiple H2 projects of the two identified types with different risk profiles and timelines to success, requiring different leadership styles, organizational cultures, and investment commitment.

This complexity makes Horizon 2 the most critical for the ultimate attainment of innovation goals and the creation of next-generation H1 core business units.

For this reason, corporations must have a particularly clear understanding of how their success in Horizon 2 will contribute to the corporate innovation initiatives, and what actions will maximize the probability of this success.

The corporation’s CEO must not only make the investments required by each of these efforts but must also stay fully connected and engaged during the duration of each of these initiatives as they transition across horizons to give the corporation its next-generation growth engines.

But...

LARGE COMPANIES ARE STILL DYING AND IT’S SELF INFLICTED

While internal innovations are well and good, colossal corporate firms trying to innovate within their existing structures do not work, Accenture's Narry Singh says.

At the WIRED2016 conference in London, the global head of growth and strategy for Accenture Digital explained that when large firms attempt to move quickly it doesn't always work and they run into problems.

"Many large companies are dying," he says. "Parts of businesses are being attacked by other companies and startups."

"In general the decline of large corporations has increased in the last 12 years or so." However, this has been counteracted by the growth of a number of technology firms: Amazon, Facebook, Netflix and Google, are just some of them.

But, in a large number of cases "corporate innovation does not work" because firms are still too slow to move and change their working practices, Singh explains.

Throwing money at innovation schemes doesn't mean they will be successful.

According to Accenture's research, corporate innovation, accelerators, and venture capital schemes are not always the best approaches for some of the biggest and oldest firms.

Singh says that the common 'fear of failure' is often misinterpreted.

The belief that startups fear failure because they will go out of business and large corporates move slowly on projects because they are afraid is incorrect, he says.

Instead, he believes that for startups there isn't a fear of failure. Instead, there is the fear of not succeeding.

The solution to the problem? Collaboration, he says.

From Accenture's research, Singh has seen that where large corporates work with startups, that's where business victories are created.

Targeted research by large companies, investment in startups, scaling companies up and venture co-development can be successful options for business leaders to take.

General Motors investing more than $1 billion in self-driving car technology, is one example.

Research has shown that now 80 percent of corporates are either interested in working with or knowing more about startups – this wasn't the case five years ago.

With existing business models in many different industries reaching maturity and providing little or no growth, and startups disrupting them with their new solutions, corporations find themselves more than ever in need for creating new businesses.

But few corporations are able to consistently create from scratch new, big businesses that use innovative technologies and employ novel business models.

For reasons explained here, it is slowly becoming apparent to corporations that the innovation model that is based solely on the efforts of corporate R&D organizations is no longer sufficient for addressing the long-term growth goals they need to achieve.

To address these issues, achieve their growth goals, and avoid being disrupted corporations are starting to tap on the innovations of startup ecosystems.

However, they must now learn how to select and grow these startup-centric efforts into their next-generation core businesses.

Because of the challenges they face, corporations must learn to innovate:

- At a faster rate and more cost-effectively;

- By leveraging entrepreneurship and intrapreneurship;

- By combining technology with business model innovations;

- By understanding the different levels of risk involved with each innovation type,

- and assessing the effectiveness of each innovation through a portfolio-management approach

- and Key Performance Indicators (KPIs) that are appropriate for the type of innovation.

WHAT GOT YOU HERE WON’T GET YOU THERE

We now begin to see the growing trend: startups need to be understood, accessed and harnessed in order to be more innovative and prevent gradual decline of core business units and income streams.

At their core they are relatively simple: a startup as a concept is pure focus of innovating something faster.

Considering then that the vast majority of startups fail allows for only one premise about them to remain -- experiments.

The most key takeaway in this entire document is then this:

unbeknownst to most corporations, the role of a startup in the ecosystem is (drumroll) outsourced R&D.

As a metaphorical Petri dish of trying things, and things here is defined as: different business models, different demographic segmentation, different clients and sometimes different marketing tactics.

This, like every Petri dish, under the right circumstances, does have the opportunity to grow to exponential values.

Take the celebrated Dollar Shave Club (below) as an example.

Ultimately the exact same product as the well established competition, although produced at a lesser price point, and presented with a massive tectonic shift by way of customer retention: a subscription model.

Yet this small change landed them a $1 billion dollar price-tag from none other than UniLever.

Not bad for a company that was only adding about $220 million to their yearly bottom line.

And so we see that there is a birds-eye view of 3 fundamental pieces.

Innovation for Dollar Shave Club was one similar product, one minor categorical shift and one major delivery shift.

Others could be any combination of 3 categories: a status quo, a minor and a major.

- Uber: Same general product as a taxi cab. Minor change in price. Very different delivery system.

- PayPal: Same general product as a bank. Minor change in price. Very different delivery system.

- Amazon: Same general products as Wal-Mart. Minor change in price. Very different delivery system.

This is also why Silicon Valley loves their familiar pitch : It’s like X for Y.

This is done so the recipient can quickly understand where the shift happens away from the familiar. There’s even an online platform dedicated to creating the ridiculous… or occasionally genius pairings at random, called Nonstartr, by online startup blog, LaughingSquid.

A few examples from their site:

- It’s like Birchbox, but for emoji’s.

- It’s like DrawSomething meets grinder.

- It’s like eBay meets SoundCloud.

- Or my favorite -- it’s like Match.com, but for puppeteers.

While the humor is obvious, the evidence should also be just as transparent.

New Innovation is then also: Like X for Y.

All of it is just an experiment. Suddenly a corporation can compete with anyone that is moving slower than they are.

That is the secret to a successful startup and thus, as pointed out earlier, the secret to innovation is: to experiment with one small facet in a largely different way.

If not, there is always: It’s like AirBnB, but for microwave ovens.

HOW MANY EXPERIMENTS DOES IT TAKE TO BLEED OUT?

Take away the idea, the term and the definition of a startup and continue down the lens of instead only seeing them as novel, outside experimentation.

Take then the costs associated with each and perhaps even more importantly, the presumed several hundreds of thousands of these experiments that occur every year which didn’t make the cut into the filtered results above.

These are validated concepts -- regardless success or failure, which can provide ideas, insights and inspirations. Changing the narrative suddenly changes the game: R&D is only being done outside of these walls.

Corporations just have to find it and bring it in. (Again, a throwback to our core point of access.)

The reason these startups are so important is that emerging business models and startups ultimately become tomorrow's leaders and tomorrow's problem.

Here (above) we see Clay Christensen’s disruptive innovation framework.

What's displayed is the products and services that are at the low-quality use end of the spectrum in the beginning slowly move up over time, and increase performance -- eventually becoming able to handle a lot more demanding use cases.

Pointing to eBay as an example, eBay started off as an online Beanie Babies exchange (Yes, seriously) and then ultimately moved up into cars and art and houses etc..

And Amazon's Jeff Bezos?

After making a list of the ‘top 20’ products that he could potentially sell on the internet, he decided on books because of their low cost and a universal demand.

The first homepage of Amazon.com.

It turns out, it was just the beginning.

So what was once a trivial, fringe use-case eventually became much larger, and a lot of technology companies start in a similar fashion. Of course, we can’t all presume to be able to harness these low-quality use cases when they are still in that phase, right?

Wrong.

If corporations were to again change perspectives into being proactive about innovation instead of reactive, their thesis on the matter would change.

The average lifespan of most Fortune 500 companies have been cut by nearly 70% in the past 50 years. One could say it’s hard to stay on top when you get there -- but the cause is generally outside threats.

Take for example if Kodak was to become the entire image category.

Anything that had to do with an image, they were proactive instead of reactive.

Simply, and soon enough, by today they would also be Instagram.

Perhaps not Instagram specifically, but it could have been an acquisition

target had they seen the writing on the wall.

They also would be Getty Images. Canon. Google Image search. Augmented reality and so-forth.

But can they keep up? Tomorrow's problems are caused by the cheapening cost of innovation.

Exponential Technologies

In the 2000s, during the dot-com boom, the cost to launch a startup was almost $5 million dollars.

Companies then raised hundreds of millions to dump into their own private servers (replaced by cloud), infrastructure (replaced by unified IT solutions), routers, switches and specialty programmers.

What we’re seeing in addition to the costs coming down, the adoption curve when it comes to technology is moving faster than ever.

Technology, and its level of adoption over time has increased exponentially in the past 10 years and will continue to do so with more open sourced solutions being taught in schools as promising young adults begin to build upon it.

Systems which used to be so complex only 20 years ago are now childsplay -- perhaps literally.

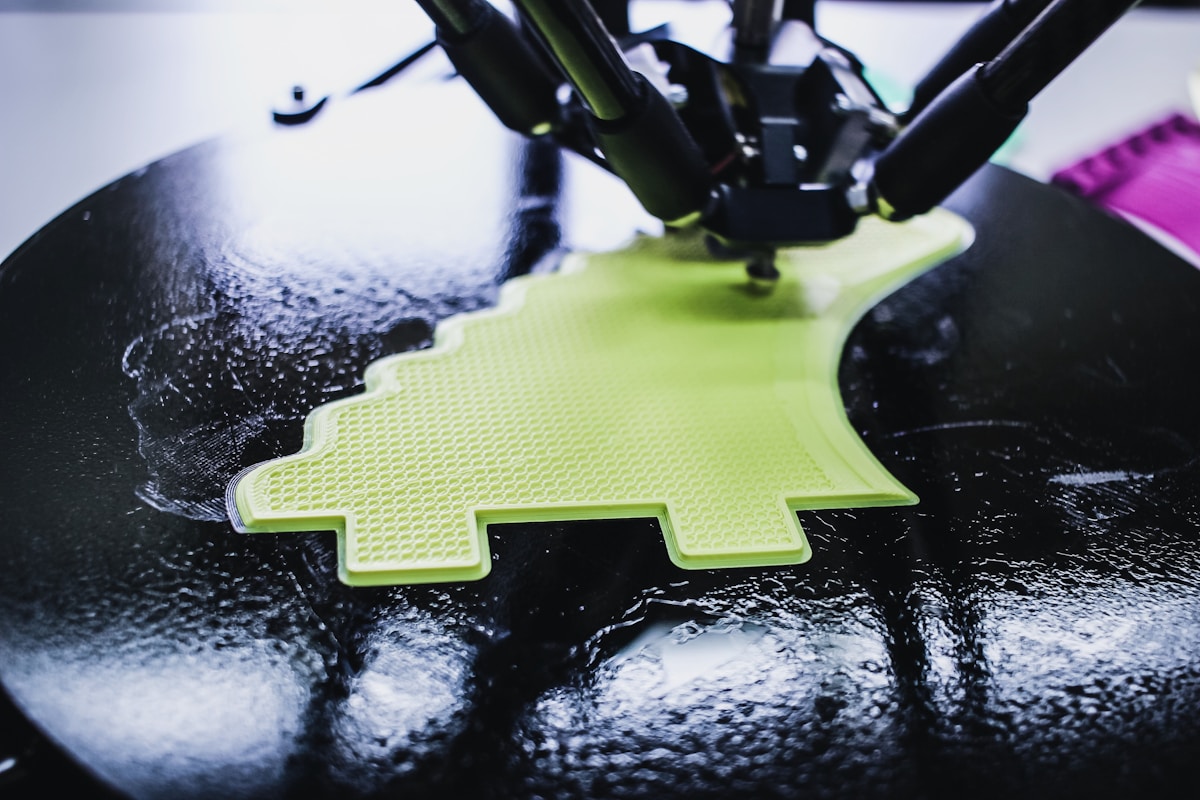

Arduino, for early-stage robotics, is creating the next wave of IoT devices. 3d printing is disrupting nearly every industry for its ability to create, model, prototype and develop.

Corporations must then ask themselves Are we equipped to experiment in the same way that startups do?

And generally, the answer is a resounding no.

Corporations who do experiment are still spending the same amount as the startups of the early dot-com days while they should be looking to understand how these young upstarts, without an ounce of the same financial power that a corporation has, was able to achieve exponentially more with less.

How to find out? Watch them. Otherwise, innovation occurs at a massive expense and the output is incremental at best.

RESEARCH AND DEVELOPMENT -- I.T.’S NOT FOR EVERYONE

Culturally at corporations, there are experimental impediments.

The end-game of which tends to be a failure -- something that is certainly not praised within large organizations.

However, find yourself in a bar in Palo Alto and you may very well come across a post-mortem party.

These gatherings of startup founders celebrate the last days of a startup, share lessons learned and move on to the next experiment.

In a large organization, re-allocation of resources become problematic in a post-failed-experiment world.

What's more, the ambient noise of quarterly earnings releases, in the case of a publicly traded company provides an additional stress-point.

It is then without question that the best ideas are not coming from within large organizations. Even on the rare cases that they do exist, there is not an outlet to properly harness and develop them.

Which certainly makes a strong case for venture capital and acquisition divisions, but even an absorption of something innovative doesn’t necessarily impact the DNA of a company itself.

Lastly, most corporations seem to be more concerned about current market share -- or to put it more simply, a large company is primarily concerned with other large companies.

In summary, most Fortune 500 incumbents follow a pattern:

- Dismiss the disruptive factors that could lead to their demise.

- Wait for their stock price to start slipping.

- Tout their internal innovation.

- Panic and throw money at it.

- Make a crazy acquisition.

- Replace the CEO.

While corporations end up taking one another out, as pointed out earlier: technology is now the easy move and death by a thousand cuts is going to be the new norm.

Unless there's a better way?

THE STOPLIGHT INNOVATION TECHNIQUE

You were probably thinking we would never get back around to the technique itself, didn't you? Let's bring up that diagram again.

OVERVIEW (AND REVIEW)

The Stoplight Innovation Technique was designed to ensure all of the elements we discussed (at unapologetic length), above, are taken into consideration.

We talked about...

- access and innovation by proximity,

- the innovation horizons,

- rapidly implementing solutions and experiments, and

- gaining input from key departmental stakeholders

After building our core thesis, examining the environment of corporate innovation (as well as corporate startup engagements), we then arrive at this technique as the necessary output.

Let's start with what's most notable.

Sourcing

Sourcing is the most important part of engaging with startups. But, taking a pause from our routine narrative, when I say sourcing, you'll be surprised to hear I'm not referring to the sourcing of startups.

Here is the current gold-standard in corporate startup engagement: You're a large financial services company?

Just source some FinTech startups. Have a FinTech event. Create a FinTech accelerator. Make a FinTech startup engagement department.

Makes sense right?

Wrong.

I'm talking about sourcing things internally that needed to be solved -- like yesterday.

Looking at the front of our diagram, these things are the bubbles as well as the recycled aspects in the bottom of the stages (the pipes).

Things like:

- Core, H1 Challenges

- Vendor consolidation

- IT debt

- Innovation gaps

- Rapid opportunity capitalization

- New business extensions

- Unexplored growing trends

- Disruption defense

STEP ONE: Your task is to go out into your company, put on your open innovation hat, and round up as many of these things as you can.

Talk to everyone. Ask them what keeps them up at night.

Throwback: Innovation is proximity.

Be on the look out for what they know.

I don't mean a simple idea exchange -- I mean watch for the things they're passionate about.

Here's how to spot the difference of things that can and can't be solved with CSE. The beginning of the sentence starts with the word know.

During these conversations, you'll hear things like:

- "I know this is <threat> coming for us" when talking about disruption.

- "I know this <innovation> would be a huge win for us" when talking about a trend.

- "I know we need to explore this" when talking about an opportunity.

- "I know we are spending way too much on this" when talking about IT debt.

Step two: Ask them why they're not doing this thing.

Then, listen to their response and wait for what we call "the if follow up".

- ... if we don't do something.

- ... if we just had a budget.

- ... if I could just get someone else to buy in.

- ... if we could find a solution fast.

- ... if it wasn't so expensive to try it out.

Them "I know we should be exploring digital twin solutions."

You "That's sounds like an interesting idea. How come we're not doing that?"

Them "Well, we would be! If I could just get a fast solution together."

You "How about we scope a pilot together and I'll bring you a solution in 90 days?"

Them "Done!"

aaaand scene.

Now back to our Stoplight Innovation Technique for a second (below)

Reviewing our first strategy, a 15-minute conversation has already taken us past the Front-End Evaluation, Strategic Guidance (top of diagram) and the Pilot Concepting (grey) stages.

You've primed the pump. You've become the nexus for innovation.

Sounds easy enough.

We've also implemented Phase I of Stage Gated Oversight (red) by bringing in departmental guidance and tapping a stakeholder/sponsor.

You can tap this person for meetings because let's face it -- this helps them 100% and helps you 10%.

The difference?

You're going to do this 50 times a year. Based on the above math, you're theoretically at 500% for a given year.

And as an aside, you can analyze the results of your sourcing phase and start pairing them together. Quite often solutions can be multi-purpose and the startup will thank you for it.

STOPLIGHT-ING

This next part is incredibly easy as well.

Step 1: Run a pilot with a startup based on the pilot concepting phase that was created with the "know" and "if" guy (or girl) from above.

Step 2: Did the pilot go well? Here are your options:

- Ship it to the venture capital group for seed investment, or

- Double down on the venture client model and become a larger customer

Step 3: Did the last stage go well? Here are your options:

- Form a partnership with the startup.

- Collaborate further on initial pilot in size and scale.

- White-label, license technology, etc..

Step 4: Did the last stage go well?

Wait for their next round and invest again.

Step 5: Did that investment go well? Make an offer to acquire the startup.

What if it fails?

Recycle and add it back into your sourcing analysis.

CLOSING: FINDING A ROSETTA STONE OF INNOVATION

Combining all of these pieces together, we can then see the milestones ahead of which need to be conquered in order to innovate with startups.

These milestone insights which are paramount to resolve, right now, are:

- How to: Identify emerging technologies & trends that are redefining consumer & market behaviors.

- How to: Discover state-of-the-art solutions to address evolving business challenges and opportunities.

- How to: Partner and pilot with startups to accelerate tangible innovation outcomes

- What “Startup Innovation” really is, why today’s top brands are doing it, and where brands can begin or improve upon this initiative.

- How an organization can implement a structured innovation methodology that delivers 3x the results in half the time – at a fraction of the cost.

- How corporate venturing really works and what your organization can learn from startup culture & agile innovation practices.

- How to: identify and engage with today’s best startups and go from ideation to pilot solution in a few short months, instead of years.

- How to: tap into the 45$B revolving startup ecosystem to gain early insights and discover competitive advantage.

- How to: gain insights on: the latest emerging technology trends are and how they will reshape your business & consumers over the next 10 years.

About the Author: Anthony W. Richardson is Founder of Gearbox.AI. In his prior life, he was a hired gun for venture capitalists, an author, a speaker, an entrepreneur and an advisor to global accelerators with a focus on growth, finance, and scale.

About Gearbox: Gearbox.AI provides the leading corporate-startup engagement solutions designed to help innovation leaders, corporate development professionals, and strategic partnership executives master the art and science identifying and aligning with what's next. Through a unique combination of a corporate membership community, AI-driven software, and cutting-edge expertise, Gearbox is focused on helping corporations keep pace in an ever-changing digital world and providing startups with new avenues for growth. The result for modern innovators is unprecedented agility, risk management, and superior results.

Headquartered in St. Louis, MO with offices in Denver, Chicago, and Los Angeles, Gearbox serves as a pivotal partner to Fortune 500 corporations and a champion to innovative startups.

.

Want more content like this? Subscribe below. Opt-out anytime.